The CPI Lie: How the Government Hides the True Inflation Numbers to Escape the Effects of Its Own Spending

How Hedonic Adjustments Make the Goverment's Inflation Metric Utterly Useless

With Biden in the White House, inflation has been back in the news in a way it really hasn’t been since the days of Carter and the early years of the Reagan presidency. Prices are up, interest rates are up, and the media, whether independent sites or the MSM, is full of hand-wringing and worry or blasé indifference to the monthly CPI (Consumer Price Index) updates.

The problem with that is that CPI is mostly useless as a metric thanks to how it is calculated, with the “hedonic adjustments” made to it used to cover up the fact that inflation is roaring out of control and has been for a long while.

Note: This is the second in our economics series. The first, on the Social Security scam, is available here. This article is also shorter than most so the main point, CPI being a lie, isn’t the forest lost for the trees. Finally, a special thanks to Rudy Havenstein and his Substack for the inspiration for this article. Check him out here.

Did Used Car Prices Really Hold Steady for Decades? The Misdirection at the Heart of CPI

Two Easy Examples

How You See Things

If you used to eat ribeye steaks when they cost $5 a pound, but then had to switch to ground beef when it rose to $5 a pound but ribeye jumped up to $15, would you say that inflation had impacted your life? “Absolutely,” you might say. “Thanks to inflation, I’m now eating ground beef instead of a tasty steak for dinner! Even if my household expenditure on meat is what it used to be, my dinners were ruined by Bidenflation!” There might be a few more four-lettered words mixed in that response, but it’s broadly true: inflation priced you out of a better thing, making your life worse, even if the nominal expenditure on the broad category of goods is similar to what it used to be.

Similarly, if you used to be able to buy a boxy TV made in America for $200, but now the only TVs for sale are “better” plasma-screen ones made in South Korea…that cost $2000, you’d say that your household expenditure on TV equipment rose. “Better” or not, the plasma screen one obviously costs more, meaning that your outlay on TV equipment, whenever it must be bought, it higher.

How the Calculators See Things

Well, all that might be true in real life, but it’s not how the statisticians behind CPI see things. To them, “hedonic adjustments” and “substitution” need to be taken into account. Broadly, those relate to the substitution of goods and improvements to goods mentioned above.

Thus, if you used to spend $5 per day on ribeye but now “substituted” ribeye for ground beef, which costs $5, there was no inflation! Sure, ground beef rose from $2 a pound to $5 a pound while ribeye rose from $5 a pound to $15 a pound, but you still spend $5 per day on meat because of substitution, so there was “no inflation.” That means CPI is 0% for that time period even though ribeye tripled in price.

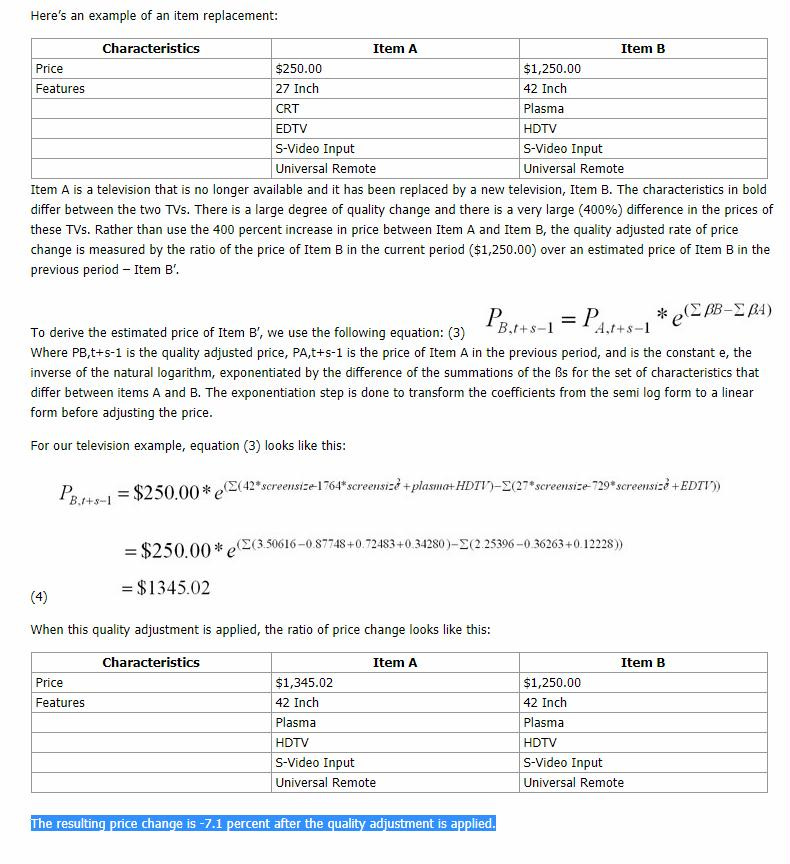

Much the same calculation is made with “better” goods, which is where “hedonic adjustments” come into play. Using the TV example above, you might think the TV slice of inflation would be 900%, as your TV outlay went from $200 to $2000, a 900% increase. Not so to the powers that be. To them, the new, plasma screen TV is far better. It has 4k resolution! It has a curved screen! It can connect to the internet! So really the price didn’t rise because of inflation, the good just got better. Thus there is no CPI inflation thanks to that “hedonic adjustment.”

Using the two examples above, your personal inflation would be 200% for the beef you used to eat and 900% for having a TV in the house. But to the CPI calculators, there was 0% inflation thanks to “substitution” and “hedonic adjustments.” And that’s the poisoned root at the heart of CPI: instead of just choosing a basket of goods and tracking them over time to see how prices are rising, various substitutions and adjustments for quality are factored in, hiding how much costs are rising for normal people.

That’s why you get nonsense like the below chart. Grocery store prices have obviously risen. But if you’ve “substituted” potatoes for bread or ground beef for steak, then the BLS claims that “grocery store prices are roughly unchanged.”

And here’s how “hedonic adjustments” work, using TVs as an example:

Did the TV actually get cheaper? No, no it did not. But is it considered “cheaper” for the purposes of CPI? You bet! Do you see the scam yet?

The Used Car Chart: The Most Obvious CPI Lie

The most obvious example of CPI being an absolute fabrication comes from its calculation of car prices. Everyone who has driven past an auto lot, seen a commercial for cars on TV, or had the misfortune of having to buy a car when COVID-19 snarled supply chains knows that car prices have risen dramatically over the past decades, with the past few years being particularly painful.

But to the Federal Reserve and BLS, the calculators behind CPI, it doesn’t matter that you’re having to shell out $40,000 for a vehicle to get to work when you used to have to spend just $15,000 for a vehicle that would get you to work and break down less. To them, the various gizmos and updates to the “average” car mean that prices didn’t rise a bit! Like the TV example on steroids, “hedonic adjustments” mean that car prices held steady for the purposes of CPI, at least until the supply chain disaster that was the pandemic. Here’s that chart:

And here’s what that means for you:

Did used car prices really hold steady from the mid-1990s to 2020? No, they did not. The average cost of a used car in 1995 was $8,0931 and the average cost of a used car in 2020 was $20,618.2 Prices rose substantially. But to the calculators behind CPI? Prices generally held steady over that period, and, in fact, dipped for much of it! That’s how they “calculate” the CPI lie.

Why Would They Lie About It? Debt Default Arbitrage

So, why do they do it? What’s the point? Is it just to cover up their incompetence and money printing, or is there more going on?

Based on what is known about the looming debt issue and the unfunded liabilities disaster, as was mentioned somewhat in our Social Security article,3 the federal government is facing a fiscal cliff that increased taxation would have a hard time handling.

The national debt is high enough that it will probably have to be inflated away or defaulted on, and the unfunded liabilities burden, which is growing by the day, is large enough that younger people would likely riot or drop out of society if they had to pay the hundreds of trillions of dollars in taxes that funding those liabilities would require.

In fact, the unfunded liabilities of the federal government, just $4 trillion as of 1989,4 had a “permanent present-value fiscal imbalance of $244.8 trillion.”5 That’s even higher now. Tack on the national debt and you’re approaching the $300 trillion mark in future liabilities, if not more.

How can the federal government get a grip on its debt and liabilities problem? It could spend less, as conservatives have insisted it should for over a century now…and then promptly spent more than ever after entering office. Beyond that, $300 trillion or more is an amount that would ruin the economy if raised with taxation. As of now, the government raises about $5 trillion a year.6 That’s between $1 and $2 trillion less than it spends, so even slashing the budget dramatically would only get us back to not expanding the national debt, even as unfunded liabilities rise. Raising taxes to the point of paying back the debt and funding liabilities would mean raising taxes to the point of diminishing returns and absolute outrage from the public. What 25-year-old would pay a 50% tax rate so that a 65-year-old could retire? Probably none, so people would drop out of work and intergenerational hatred would skyrocket.

All that’s to say that taxation to pay the debt and fund the liabilities isn’t realistic. That leaves outright default or default by inflation, which is where CPI comes in.

The national debt can be whittled away by inflation in a way that will be horrible for normal people but is conceptually easy to understand. If it costs $30 trillion in 2022 dollars but inflation devalues the 2022 dollar to a hundredth of its former value by the time it’s due in 2052 (assuming, for ease of understanding, 30-year Treasury Bonds are used), then really the debt only cost $300 billion in 2022 dollars. That’s much more realistic to pay off, even if the middle class is wiped out by inflation and bondholders are left with worthless paper in the interim.

Similarly, if the government owes $2k a month in Social Security benefits to the average retiree, then the same inflation would mean it owes just $20 a month to those retirees by 2052. That would shrink the unfunded liabilities from ~$250 trillion or so to just $2.5 trillion, which also would be much “easier” to pay off.

And make no mistake, that is their plan. The powers that be are currently calling for double-digit inflation to whittle away the government’s liabilities without canceling programs or defaulting on the debt.7

But there’s a wrench in that plan: benefits like Social Security are tied to inflation, so as it goes up, so do benefits. Thus, if the inflation metric were accurate, then the unfunded liabilities couldn’t be whittled away with inflation because benefits would rise proportionately with inflation, and bond buyers would demand a higher interest rate to make up for the cost of living going up.

How do they get around that? CPI. The benefit increases are tied to CPI. So, if a retiree on a fixed income used to live in a 2-bedroom apartment and eat meat and fruit for dinner, but now lives in a studio with roommates and eats bugs and cereal grains…the “substitution” means inflation is 0% and benefits don’t need to rise! Cars, food, shirts, and TVs aren’t getting more expensive because of inflation…they’re getting more expensive because they’re getting better! So, the CPI is 0% even if the real inflation rate on beef, nominal car price cost, rent, etc. is 10% or more a year. Thus, with that arbitrage, they can inflate away their liabilities while never having to default on their debt or cancel programs popular with retirees, who tend to vote more than younger people.

Of course, for the average person that means living with Weimar Germany or Zimbabwe-level inflation. But for the Federal Reserve and politicians, it means saving face. And, as oligarchs, they have enough resources to avoid the worst effects of inflation.