Nothing On the Horizon is Likely to Save Social Security

Yes, it's "unfair." But it's best to prepare for what's inevitable

Social Security is back in the public discourse, with those who have remained generally uninformed about the unfunded liabilities crisis until now starting to realize just how bad the financial position of Social Security and Medicare is. Social Security is particularly in danger, as once its trust fund runs out, probably in the 2033 to 2037 time period,1 it will simply be a taxes-in, benefits-out wealth transfer operation, and the taxes in won’t be anywhere near enough to pay the promised benefits.

Making the situation worse is that the population’s TFR is under the 2.1 hold-even number, so outside of immigration, it will be shrinking rather than falling. When paired with the likely retirement of tens of millions of Baby Boomers in the next decade, that means there will be even fewer taxpayers needing to pay for the benefits of an even larger base of recipients. This article will discuss what solutions have been proffered and why they will likely fail from the perspective of what will likely happen given the abysmal state of the US government.

For understanding the issues discussed in this article, make sure to check out our articles on the coming unfunded liabilities crisis, the massive cost to Western governments of mass migration, the lies embedded in the government’s CPI calculation, the problem at the root of Social Security, and the lurking workforce participation problem that mass retirements will make worse.

The Various “Solutions” Presented Won’t Work

Can the Other Parts of the Budget Be Cut

With that problem in mind, some are trying to address it in a “moderate” way. Trump, for example, suggested that cutting fraud out of the program could solve the problem: "So first of all, there is a lot you can do in terms of entitlements, in terms of cutting, and in terms of, also, the theft and the bad management of entitlements — tremendous bad management of entitlements. There’s tremendous amounts of things and numbers of things you can do.”2

For one, that’s untrue. Even if there is a substantial amount of fraud in the program, which there probably is, it’s nowhere near enough to make up for the tens of trillions of dollars in unfunded liabilities the program has already incurred, much lets the tens of trillions more it will have incurred by 2030. Were the difference marginal, cutting out fraud would fix it. But it’s not. The problem is massive and only growing larger.

Further, even Trump’s “cut the fraud” comment was enough to send people over the edge with anger, forcing him to tell Breitbart News he wouldn’t cut Social Security. “There’s so many things we can do,” he said. He continued, “There’s so much cutting and so much waste in so many other areas, but I’ll never do anything to hurt Social Security.”3

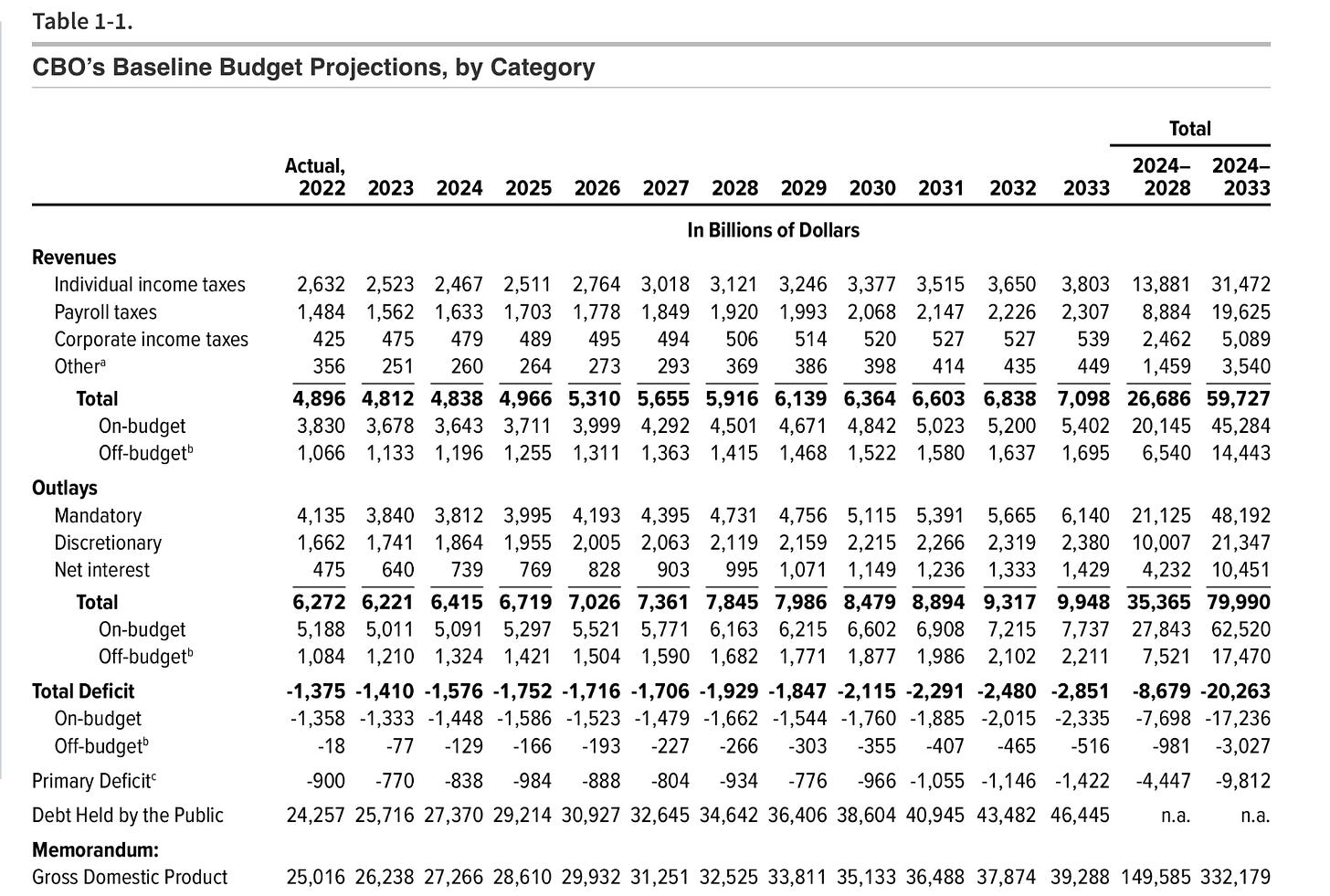

Unfortunately, that is untrue as well. There is much fraud in the federal budget, to be sure, but it is peanuts compared to Social Security. For example, the below graphic shows what the federal budget looked like in 2023. The outer ring is the total “entitlement” part of the budget. It includes federal pensions, Medicare and Medicaid, Social Security, and Income Security programs. Together, those “mandatory” programs, all of which are required by law to be funded every year, total about $3.2 trillion dollars. The servicing cost on the debt, which also must be paid unless the government is to default, totaled $0.659 trillion. So, together, the entitlements and debt cost close to $4 trillion in 2023. In 2023, the government collected $4.4 trillion.4 That means just $400 billion would be left over for everything from the military to welfare spending, which is unrealistic given that defense spending is already in the $900 billion range and will only need to go up as the world gets increasingly dangerous.

But the problem gets even worse looking to the future, as regardless of the welfare situation, which will get worse as America imports more non-European immigrants,5 the budget will be devastated by rising interest rates and fewer taxpayers needing to pay the benefits of ever more retirees.

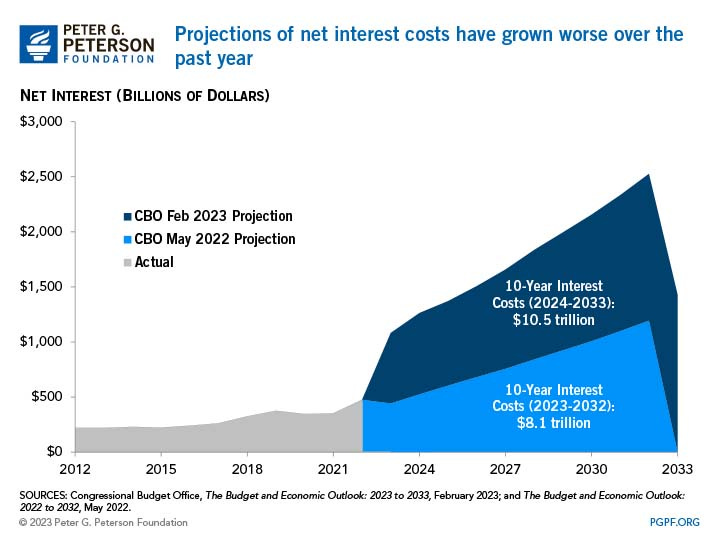

By 2033, for example, around the time the Social Security trust fund will be on its last legs,6 CBO projects that the annual interest costs will have risen to a monumental $1.4 trillion.7 That might even be a rosy prediction, as interest rates are rising faster than expected.

But, even assuming that the interest cost really will be “just” $1.4 trillion, the highest as a percentage of GDP ever recorded,8 the Social Security situation will be even worse. By then, there will be about 66 million Social Security recipients,9 and the “mandatory” entitlement spending will total about $6.1 trillion.10 So, together, the government will have to spend about $7.5 trillion just on servicing the debt and paying for the mandatory programs, and that’s assuming the debt situation doesn’t continue to get worse. The expected tax revenues for 2033 are $7.4 trillion.11

All that is to say, while there is much “fat” to trim in the federal budget, that won’t be enough to save Social Security. By 2033, when the trust fund will be running out and nearly 70 million Americans will be relying on the program, the expected costs of it and the debt will already be larger than tax revenues. So, even if defense spending were cut to zero, all welfare programs canceled, and the government stopped doing everything from giving research grants to enforcing drug laws, America would still be in the red with its financial situation getting worse.

Trump is right to say other cuts should be made to the budget. Spending is out of control. But he’s wrong to suggest that doing so will make up for the Social Security gap. It’s paying out far too much and bringing in too little, and no amount of cuts to discretionary spending will make up for the interest on the debt and mandatory program costs.

Will Filling America with Immigrants Work?

The other solution presented is to buoy Social Security, Medicare, and other mandatory programs by importing vast numbers of immigrants. As the thinking goes, those programs are on the rocks because there are too few taxpayers paying for too many beneficiaries, so since the population did not have enough kids to keep the Ponzi going, millions of immigrants should be let in to make up for the gap.

As of last year, there were just 2.7 workers paying into the system for each person drawing Social Security benefits,12 so proponents of immigration think importing more workers to boost that ratio will help.

Perhaps that would be true if workers were fungible, but they’re not. Those who immigrate, particularly illegally, tend to do so because they can’t make a net economic contribution in their homelands and so are unable to find work. While that’s not true of educated professionals moving to America for its better, freer economic environment, it is generally true of the mass illegal immigration America has seen under Biden. It seems unlikely that those unable to make a net contribution in countries with sub-$1000 per-capita GDPs and little technological competition for muscle-power will be able to do so in highly industrialized, highly technological America. Robots can now replace farm workers in many agricultural operations, for example, making that traditional realm of unskilled, illegal immigrant labor no longer an area in which they could make a net economic contribution.

Such a general impression is borne out by the data, as discussed in our recent article on the economic cost of immigration: most non-European and non-East Asian immigrants are net economic drains on the treasury, not contributors.

What’s more, the study we relied on for that report specifically provided that immigrants cannot make up for an aging population. As provided in the summary of that study (emphasis ours):13

Immigration is not a solution to population ageing. If the percentage of those over the age of 70 is to be kept constant with immigration, the Dutch population will grow extremely quickly to approximately 100 million at the end of this century. Population ageing is mainly dejuvenation. Far fewer children are being born than is necessary to maintain the population. And immigration does not solve the dejuvenation. The only structural solution is an increase in the average number of children. Furthermore, immigration does not seem to be a viable way to absorb the costs of population ageing. This would require large numbers of above-average performing immigrants with all the consequences for population growth.

Singapore14 and other small states might be able to attract enough of those “above-average” immigrants. America, despite its positive characteristics, is simply too large to do so. A nation of nearly 400 million would need to attract all of the world’s talent to make up for its aging population on a cost basis, and that’s unlikely, at best. With 66 million expected retirees by 2033, it would need to attract 66 million exceptional immigrants by then just to boost the 2.7 workers per retiree to 3.7, and that’s assuming the 2.7 number doesn’t decrease dramatically in the interim, which it will as the workforce participation problem gets worse thanks to retirements and welfare programs.15 Perhaps there are 66 million exceptional people who would want to immigrate, but it’s unlikely. Further, even if it happened, replacing nearly a quarter of the population with highly talented immigrants would cause problems of its own, to say the least.

So, like cutting the fat from the budget, America would be smart to revise its immigration policy to bring in the best and brightest while keeping out the net drains. But, also like cutting the fat from the budget, doing so would be nowhere near enough of a change to be much of a help, much less fix the program.

Cuts, Taxes, and Inflation

Those proposed “solutions” won’t work, which means the program will fail, and the government will either a) recognize that and make some change to the situation to fix it or b) just let inflation rip in an attempt to inflate its way out of the problem.

Cuts and Taxes

The a) option would mean some combination of raising taxes and cutting benefits. Cutting benefits is a broad term that could mean anything from raising the retirement age, slashing the payouts to what can be paid for by taxes (about a 25% cut in the early 2030s),16 or changing the program to be means-tested, thus slashing the number of potential beneficiaries. On the other side, taxes could theoretically be raised by any percentage amount to pay for the necessary benefits.

Any of those could, theoretically, work. The problem is one of money in and money out, so anything that either raises the amount of money going in by the necessary amount, cuts the amount going out by the necessary amount, or some combination thereof, would solve the problem.

But two issues quickly arise: the Laffer Curve and the democratic process.

One is the Laffer Curve idea that raising taxes has diminishing returns,17 as it discourages economic activity. That, in turn, limits GDP growth, which is disastrous in the long run. Additionally, limited economic activity in the present means diminished tax revenues. Given that Americans are fleeing high-tax states like New York and California en masse and those high-tax states have terrible Economic Outlooks, it’s likely America is already somewhat near its Laffer Curve inflection point, even after the Tax Cuts and Jobs Act.18

So, raising taxes might raise some revenue, though not as much as likely expected, but would be disastrous from an economic growth perspective and cause more problems in the future. And that’s if taxes could be raised dramatically, which is unlikely given the hostility of all Republican legislators and voters to increasing taxes and the general feeling that taxes are already too high.

That leaves cuts. Whether of the overall amount variety, means-testing variety, or retirement age variety, those would be political suicide. Trump was raked over the coals for suggesting fraud should be cut out of the system. Actual cuts would be incredibly unpopular and lead to legislators and the president voted out en masse, particularly as retired Americans tend to vote in the largest numbers.

As most members of Congress vote in a way that helps them remain in office, not in a way that’s best for Americans a century from now, it seems unlikely all of Congress and the president could be whipped into committing political suicide over even a pressing problem. Nothing being done about the deficit and debt despite us being at peace, not being in a recession, and their incredible size indicates as much: Congress would rather use debt to punt the problem than do something unpopular but necessary to deal with it.

That is particularly true given that “cuts” would likely be some form of means testing that requires the middle class and up to pay ever-larger, uncapped amounts for Social Security with no prospect of ever getting a payout from it. That idea is something that would make it at least as unpopular as every other welfare program that transfers money from the middle class and up to the often layabout poor. Further, in that case, Social Security would lose the luster it currently enjoys as something other than a direct transfer program, adding to the political issues with reforming it and political repercussions for those that cut expected retirements of the middle class to provide more resources for the poor.

Debt and Inflation

If taxes won’t work and are unpopular, and cuts could work but are political suicide, that leaves debt and inflation. As mentioned before, the service on the debt is already a problem and is set to become double the problem in less than a decade. While printing more money via debt might seem like it would exacerbate the problem, it could, theoretically, “help,” by inflating it away. Here’s how a site called PTM Wealth described that as working (emphasis ours):19

With both inflation and our National Debt stealing headlines over the past year, the concept of deliberately inflating our way out of debt has been reintroduced into mainstream conversation. The term "inflating out of debt" refers to a situation where a government or an economy deliberately pursues a policy of generating inflation as a means to reduce the burden of its debt. In this scenario, the government uses inflation as a tool to decrease the real value of its outstanding debt over time. Of course, inflation also decreases the buying power of currencies and savings.

Here's a simple explanation of how it works:

When a government or an entity has a significant amount of debt, it means they owe a substantial sum of money to lenders or bondholders. The repayment of this debt, along with the interest payments, can create a significant financial burden.

Inflation is the general increase in prices of goods and services in an economy over time. When inflation occurs, the purchasing power of a currency decreases, meaning that each unit of currency can buy fewer goods or services.

If a government wants to reduce the real value of its debt, it may intentionally create inflation by adopting expansionary monetary policies. These policies could involve increasing the money supply, lowering interest rates, or engaging in quantitative easing (buying government bonds or other assets from the market).

As inflation rises, the nominal value of the outstanding debt remains the same, but the real value of the debt decreases. This is because the debt's value is eroded by the decrease in the purchasing power of the currency. Inflation effectively reduces the burden of debt relative to the economy's overall size.

In an inflationary environment, governments may find it easier to repay their debt obligations. Since the value of money is decreasing, they can effectively repay their debt using currency that is worth less than when the debt was initially incurred.

It's important to note that "inflating out of debt" can have both positive and negative consequences. On the positive side, it can provide temporary relief to governments struggling with high debt burdens. However, it also carries risks, such as the potential for hyperinflation or loss of confidence in the currency if inflation becomes excessive. There is no evidence that this strategy is being employed by the U.S. government. The Federal Reserve has stated that its interest rate increases are laser-focused on reducing high inflation in the economy.

Such a policy, whether intentional or an accident of fiscal irresponsibility, would help with the Social Security burden in two ways.

The first, more obvious one, is that the government could raise debt to pay the Social Security (and other entitlement) outlays without cutting them or raising taxes, then repay that debt with inflated dollars. That would dodge the political unpopularity issue. Though inflation is unpopular, it’s not as unpopular as slashing Social Security or dramatically raising taxes would be.

The second way it would help is by enabling the government to decrease the actual value of Social Security payouts. For inflation, the government and most of the public rely on CPI, a mostly made up and easily manipulated (by the government bean counters) figure.20 Social Security is indexed to inflation.21 However, those cost of living adjustments are indexed to the fake and easily manipulated CPI number.22 If the government boosts inflation while lying about how much inflation is increasing, it can decrease the value of the benefits paid out, helping dig itself out of the benefit cost hole.

Count on the Irresponsible Outcome

Making the inflation “solution” all the more likely is that it is what will happen if no one makes a decision. As America is a bureaucratic, managerial state run by a faceless bureaucracy that is never held to account for outcomes unless a controversial decision is made, that’s the most likely. Congressmen won’t want to commit political suicide with cuts or taxes, immigration won’t solve the problem, and there’s nowhere near enough fat to trim to fix the issue.

That leaves inflation, the decision that requires no decision-making other than small lies on the CPI report to fudge the numbers in a way that benefits the bean counters and lets legislators off the political hook.

I am ready to start looking for the best way to leave this country and go somewhere smaller with much less government. We have become a welfare state. And welfare states never work.

What if all SS funds collected were outsourced to some sort of private investment entity, separating it entirely from under the auspices of the federal government, kind of making it more like a 401k?

But then I’m sure they don’t even have that money “banked” that’s been collected from all the citizenry to hand over to such an entity for those future retirees promised payments, since they’ve probably spent it already, and would be caught red handed having had that red hand in the proverbial cookie jar all these decades, and not in the “lock box” we’d been lied to about.