Congressional Stock Traders Beat the Market...and Hedge Funds, Again in 2023

Late Republic America Glimpses Kleptocracy Ever More Clearly

Corruption and Dying Republics: Late Republic America through the Lens of Late Republic Rome

Self-government requires people know how to govern themselves, both in private and public life, so a sure sign of a dying republic is dying virtue. Because a republican system of governance relies on the citizenry to make decisions and choose who will represent them, both the citizens and their representatives must be morally upright people able to navigate the vagaries of life without listening to the devil on their shoulders. Or, as John Adams put it, “Our Constitution was made only for a moral and religious people. It is wholly inadequate to the government of any other.”1

When that sense of virtue begins to decline, when corruption rules rather than virtue, things start to fall apart. In Late Republic Rome, for instance, as Mike Duncan records in The Storm Before the Storm, a signal problem was that the upper class was corrupt and drifted from being a stern and morally upright aristocracy to a corrupt and rapacious oligarchy.

Exposing the corruption of the rapacious elites was Tiberius Gracchus, the populist reformer on whom we based this Substack. He famously excoriated them for using their control of the conquered provinces not to rule well and develop the empire, but instead to extract wealth and make a fortune off acting corruptly. Doing so, he said, “When I left for Rome, I brought back empty from the province the purses which I took there full of money. Others have brought home overflowing with money the jars which they took to their province filled with wine.”2

Similarly, he chastised the city’s kleptocratic elites for using their vast wealth to impoverish the common men rather than help build and maintain the foundations of Rome’s yeomanry.

The noble Romans of days past had won wars and then brought the defeated city-states into the fold, building an alliance system and winning land on which the Roman yeoman to build his life as an independent farmer. By Tiberius Gracchus’s time, by contrast, the corrupt elites had used the vast wealth won in wars against Carthage and Macedonia to buy up the land and create vast latifundia plantations that were operated by slaves, putting the yeoman out of work.3 Often times, the land with which they did so was land that had gone fallow because its owners were away fighting the lengthy wars the Republic demanded they fight.

Gracchus, excoriating the kleptocratic elite for that offense against the people, famously remarked, “The wild beasts that roam over Italy have every one of them a cave or lair to lurk in. But the men who fight and die for Italy enjoy the common air and light, indeed, but nothing else. Houseless and homeless, they wander about with their wives and children. And it is with lying lips that their imperators exhort the soldiers in their battles to defend sepulchres and shrines from the enemy. For not a man of them has a hereditary altar, not one of all these many Romans an ancestral tomb, but they fight and die to support others in wealth and luxury, and though they are styled masters of the world, they have not a single clod of earth that is their own.”4 What had been a mutually beneficial relationship between yeoman and patrician turned into one in which the richest reaped all of the rewards and those doing the work and fighting earned nothing from, or in many cases were impoverished by, their service to the state.

That then led the Romans over the edge, with their political system falling apart under the weight of a decimated body politic. As Duncan put it, “The Romans never had a written constitution or extensive body of written law—they needed neither. Instead the Romans surrounded themselves with unwritten rules, traditions, and mutual expectations collectively known as mos maiorum, which meant “the way of the elders.” Even as political rivals competed for wealth and power, their shared respect for the strength of the client-patron relationship, the sovereignty of the Assemblies, and wisdom of the Senate kept them from going too far. When the Republic began to break down in the late second century it was not the letter of Roman law that eroded, but respect for the mutually accepted bonds of mos maiorum.”5

America today finds itself in a similar situation, with a kleptocratic elite in charge that focuses entirely on its own wealth instead of the wellbeing of the American yeoman.6 That elite has systematically dismantled what aspects of America used to work for the middle class and sold them off for their own benefit.

The industrial base, once able to provide stable and well-paying jobs to blue-collar workers, was shipped to China so corporate raiders could make a few percentage points more in profit, costing millions of American jobs.7 What was left disappeared to Mexico as Ross Perot’s “giant sucking sound” dedicated American industry to make free traders feel good.8 The construction industry, once a way for a man who knows how to work with his hands to make a good and independent living, has been dominated by the millions of illegals the kleptocrats have let pour across the southern border to drive down wages.9 Industries like tech are now dominated by H1b visa-holders instead of American citizens,10 again to keep wages low, while the functions of America’s premier companies that can be outsourced are outsourced.11 Meanwhile, the oligarchs buy up housing, turning families into lifelong renters.12 Remind you of the Roman Republic?

But while that corruption and anti-American activity are all sickening, it’s outweighed in brazenness by Congress’ favorite way to enrich itself: insider stock trading, something it did to a huge extent again in 2023.

What Congress Did in 2023

In the financial services industry and business generally, insider trading is illegal. Such a law makes sense, as not having it would distort the market and give oligarchs a way to enrich themselves at the expense of retail investors. But, in the case of Congress, insider trading isn’t illegal. The Loyola University Chicago School of Law blog, explaining the issue in a 2022 post titled “Insider Trading Isn’t Illegal if You Are a Member of Congress,” wrote:13

Simply put, insider trading is illegal. But, if you are a member of Congress, there is a loophole. Members of Congress and their families are allowed to trade stocks with almost no limitations. There isn’t a limit on lawmakers trading stocks based on classified information nor is there oversight regarding the trades that lawmakers are allowed to make based on other information they are privy to as part of their job. This is in glaring contrast to the strict insider trading laws that ban the same kind of behavior of everyone else in the county.

Companies also are well aware of this loophole and even give Congress members special access to IPO stocks prior to their being made available to the general public. One example of this kind of access being offered to lawmakers was seen in 2008 when Visa offered Nancy Pelosi early IPO stock access at the very time that legislation that Visa opposed was being brought to the House floor. In two days, Nancy Pelosi and her husband made over $100,000 in Visa stock alone and the legislation in question was never allowed on the House floor for a vote.

…

In April of 2012, Congress passed the STOCK Act, a policy that on its face would address the problem and curtail the type of insider trading that lawmakers have been able to profit off of. But the STOCK Act has effectively been gutted in the ensuing years following its adoption. One key portion of the STOCK Act that has been neutralized is the disclosure provision. This change removed the accessibility and transparency of the original version of the Act that made these trades by lawmakers readily available for the public to see.

As a result of Congressional stock trading not being illegal, those unscrupulous members of Congress looking to make a buck are easily able to do so. Such was the case in 2013, in which 115 members of the 118th Congress traded over $1 billion in stocks in over 11,000 transactions and significantly outperformed the S&P 500 ETF, SPY.14

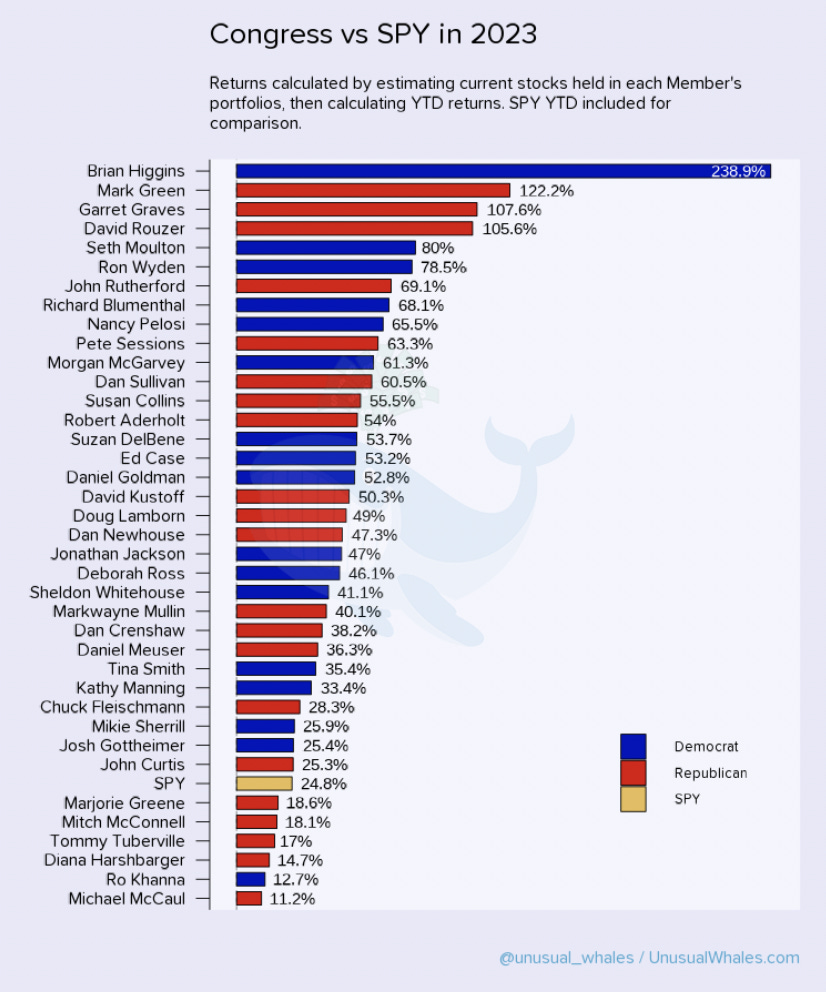

Such is what the Congressional stock-trading watcher “Unusual Whales,” famous for its 2022 report on Congressional stock trading,15 found in its 2023 report on Congressional stock traders and their massive outperformance over the S&P 500.16 Here’s what Unusual Whales found:17

Unusual Whales also found that the Democrats, despite their professed love for the lower class, blew Republicans and the SPY fund out of the water:18

But, as can be seen in the first chart, some Republicans outperformed the SPY too. For example, Dan Crenshaw, a noted defender of Congressional stock trading,19 beat the SPY by more than 13 points. This is the third year in a row that Rep. Crenshaw, by trading stocks and options, managed to outperform the S&P 500.20

Outside of trading based on insider activity, that record of success is improbable at best. As AEI noted in a 2018 report on how many active fund managers outperform the market:21

Stated differently, over the last 15 years from June 30, 2003 to June 30, 2018, only one in 13 large-cap managers, only one in 21 mid-cap managers, and one in 43 small-cap managers were able to outperform their benchmark index. So it is possible for some active fund managers to “beat the market” over various time horizons, although there’s no guarantee that they will continue to do so in the future. And the percentage of active managers who do beat the market is usually pretty small – fewer than 8% in most of the cases above over the last 15 years; and they may not sustain that performance in the future. For many investors, the ability to invest in low-cost, passive, unmanaged index funds and outperform 92% of high-fee, highly paid, professional active fund managers seems like a no-brainer, especially considering it requires no research or time trying to find the active managers who beat the market in the past and might do so in the future.

Similarly, a report from Wharton Business School found that only 10% of active fund managers are able to outperform their benchmark index three years in a row.22

If 90-95% of active managers, people who dedicate all day every day and vast amounts of research time and computing power, can’t beat the market consistently, if at all, it’s unlikely that a member of Congress who is theoretically spending his day legislating and politicking could do so three years in a row. While the report notes that some of the Congressional stock traders “have disclosed more stock trades than legislative votes,”23 indicating where their priorities lie, it’s still unlikely that they managed to reap such rich rewards without insider information.

The Public Can See What’s Going On

The public isn’t blind to what Congress is up to. A 2023 survey by the Program for Public Consultation (PPC) at the University of Maryland’s School of Public Policy found, for example, “Overwhelming bipartisan majorities favor prohibiting stock-trading in individual companies by Members of Congress (86%, Republicans 87%, Democrats 88%, independents 81%), as well as the President, Vice President, and Supreme Court Justices (87%, Republicans 87%, Democrats 90%, independents 82%).”24

Despite the public’s frustration with its corruption, Congress has refused to act. Dan Crenshaw, who is either corrupt or should be running an investment fund and enshrining himself as a better fund manager than Warren Buffett and Peter Lynch, has even defended the idea of members of Congress trading individual stocks. When pressed in 2022 over his being one of 35 members of Congress that beat the market, he said, “Just keep in mind that no one will run for Congress because you have no way to better yourself.”25

Similarly, Nancy Pelosi, so notorious a stock trader that an index fund has been created to track her trades,26 said, “We are a free market economy. They should be able to participate in that.”27

Legislators brazenly trading stocks and options in the companies they regulate and getting obscenely wealthy by doing so,28 then defending their conduct on the basis of the “free market” and self-advancement is so offensive and repugnant it would make the Late Republic oligarchs blush. At least they were ashamed enough to hide their corruption instead of claiming self-enrichment at the expense of the public is virtuous. But, regardless of optics, as those Senators of Late Republic Rome “brought home overflowing with money the jars which they took to their province filled with wine,” now our Representatives are following in their footsteps and bringing home brokerage accounts full of capital gains in stocks of companies their constituents expected them to regulate.

The Storm Before the Storm: The Beginning of the End of the Roman Republic

Noting that he outperformed in 2021: https://texassignal.com/crenshaw-on-congress-trading-stocks-you-have-no-way-to-better-yourself/; noting that he outperformed in 2022: https://unusualwhales.com/politics/article/congress-trading-report-2022, and https://twitter.com/unusual_whales/status/1610284037758922757 shows his outperformance clearly